Technology

Popularity of smart speakers prompts insurers to develop smart speaker skills

Smart speakers will become omnipresent in households in the coming years. Insurers are beginning to recognise the opportunities this market can bring, with LV= developing a new voice app for car insurance customers. GlobalData Financial Services writes

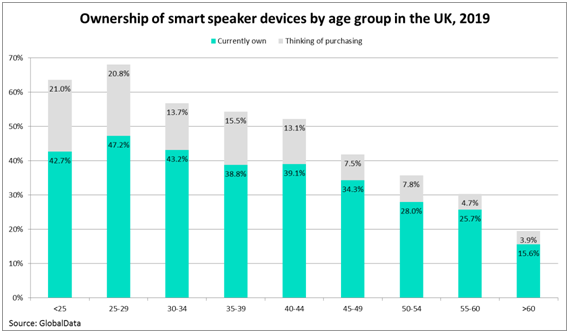

GlobalData predicts that there will be over 200 million installed smart speakers across the world in 2020. These are currently most popular among the younger generation, with almost half of those aged 25–29 in the UK owning one. As the underlying technology develops to add more functionality to the speakers and improve the user experience, they will continue to grow in popularity.

While initial applications for these speakers are limited to functions like playing music, asking simple questions or placing a phone call, as the technology driving these devices develops, more applications will become ubiquitous such as retail shopping.

However, it will still be some time until insurance is purchased solely through interaction with a smart speaker. Because insurance contracts are much more technical and enter the legal arena, it will be difficult to develop a skill that can capture all the necessary information from a consumer and then relay the terms of the insurance contract in full. Retail shopping with smart speakers will need to be the trailblazer for consumers, with insurance shopping coming after. Contracts that are more simplistic, such as smartphone insurance, will likely be the first insurance products to be completely purchased through a smart speaker.

LV=’s skill initially allows anyone to ask their device over 500 policy-based questions, based on commonly asked questions through its online chat or call centre. The insurer thinks that this will free up time so that its call centre staff can spend more time dealing with in-depth queries. Currently, only general enquiries can be asked; personalised questions, such as how to change a payment method, must still go through LV=’s existing contact channels.

It isn’t the only insurer that has developed one either. Ladder, a US life insurance company, developed a skill that allows users to receive a life insurance quote after answering a few questions, all through the app. While these are both rudimentary offerings, we will likely see the development of more complex apps in the future as insurers look to capitalise on this growing market.