STRATEGY

Crowdfunding and auctions: honcho’s way to take on insurance

Normally, the first stop for any consumer looking for a new insurance policy is a price comparison website (PCW). However, while this can help reveal the cheapest policy, honcho believes it can hide the best ones. It has come up with a different method. Patrick Brusnahan writes

A popular form of finding investment, crowdfunding has helped honcho yet again. At time of writing, it beat its target of £700,000 ($910,871) and has raised more than £1m.

Durham-based insurtech honcho is no stranger to crowdfunding. It has its first exercise from December 2017 to February 2018. In that showing, it aimed for £650,000 and closed at £850,000. Again, with its most recent round, there was an “expectation” that honcho would receive more than it was asking for.

Gavin Sewell, CEO, honcho

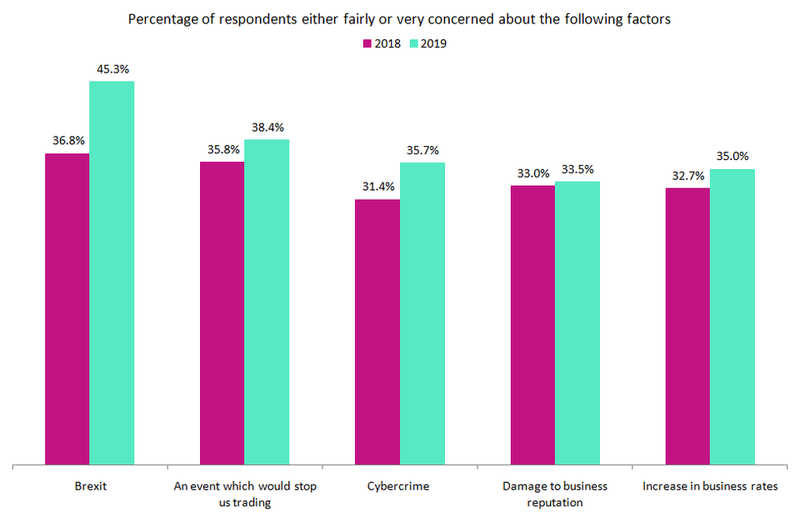

Source: GlobalData's 2019 UK SME Insurance Survey

Does this mean there is a demand for an alternative to PCWs?

Speaking to Verdict InsurTech, honcho CEO Gavin Sewell says: “If you have a B2C proposition in financial services that is going to change the day to day lives of individuals, individuals who use crowdfunding platforms as well, then that's something that is going to gain some significant traction.

“We’re lucky that we have a proposition, a consumer champion proposition. People understand it, it addresses a problem in their everyday lives, that's the kind of proposition of business that should fund well in crowdfunding. I think there's definitely an appetite for a new digital consumer centric approach to financial services.”

Standard PCWs have a strong appeal to customers, giving them a list of policies and showing which is the cheapest. But are they offering the best?

“PCWs really push this race to the bottom mentality, you must buy that you must buy the cheapest, andthe top of the list is always the cheapest policy,” Sewell explains.

“What's happened over many years is those policies have been stripped of features and functions to make them cheaper, so they get to the top of the list. And of course, that's not particularly great from a consumer perspective, because really, what you want is something that's actually going to give you the coverage that you need.”

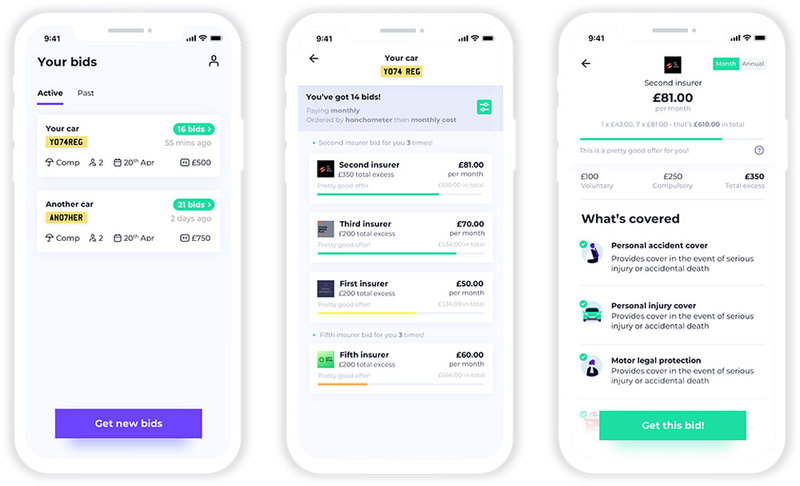

honcho gives the consumer more control. It lets the consumer ask for what they need and partnered insurers “auction” for the business. They are also charged to enter in order to dissuade them to enter just for the sake of it; they have to offer what the customer wants.

After that stage, insurers see what everyone else has offered and they can bid again. This enables the firms to “compete with both product and price to present the best product at the best price to consumer”.

Policies are then differentiated by the “honchometer” which shows if something offers what the consumer has asked for.

insurers

Currently, there are eight live market participants, with around 30 insurance brands and carriers underneath those participants. Contacts have been signed with another eight and integrations already underway with a number of them. honcho hopes to have close to 40 by the middle of 2020.

In terms of why insurers would join this system, Sewell explains: “We're seeing really good traction from the insurers to join our panel because they’re not that particularly happy with the status quo that exists with the price comparison websites today.

“They are looking for alternative distribution channels. They don't like the PCW model too much as it's expensive. They find that they find that the PCWs have quite anti-competitive terms in their in that contract. Also they don't react quickly. Insurers wanted to bring on new schemes, new product types.”

Size and scale

Currently, honcho is targeting younger demographics with its paid for marketing and around 30% of sales have come from that demographic. However, there are much bigger plans.

Sewell concludes: “Clear competitors to us are price comparison websites. I mean, that's certainly who we're differentiating against. Certainly on the personalised insurance market, most of them are capturing 70% of all new business. They’re really capturing a lot of the market.

“We have long term aspirations to be of a similar size to those guys, but in the next few years we're trying to win to 20% of the car insurance market. We're not after vast, vast amounts or vast quantities of the car insurance market at the moment.”